No Euro Paradoxes Here, Just Plenty of Euro Folly

In economics, there is a remarkable “stickiness” in bad ideas and confusions. In fact, some bad ideas and confusions never seem to go away. For instance, last summer Martin Feldstein bravely suggested that euro weakening would help solve the euro crisis and rescue Europe (WSJ: “A weaker euro could rescue Europe”). Similarly, in a Bruegel Institute Policy Brief also published last summer and titled “Intra-euro rebalancing is inevitable but insufficient,” Zsolt Darvas argued that euro weakening was badly needed to restore competitiveness of euro crisis countries whose perceived inability to rebalance their external positions was a major root of the euro crisis. More recently, these two issues, euro external competitiveness and intra-euro competitiveness imbalances, were also bundled together in a piece by David Keohane titled “Why strength could be the single currency’s undoing” (FT.com 17 April 2013). Mr. Keohane seemed to identify a “euro paradox,” or even two paradoxes actually. One apparent paradox is that policy measures by the euro authorities that boost confidence in the euro run the risk of doing damage to it by undermining its long-term existence through enticing euro strength, which would postpone an export-led recovery. The other seeming paradox is that the single currency cannot exist at different levels for different countries and that it will therefore always be expensive for some and cheap for others.

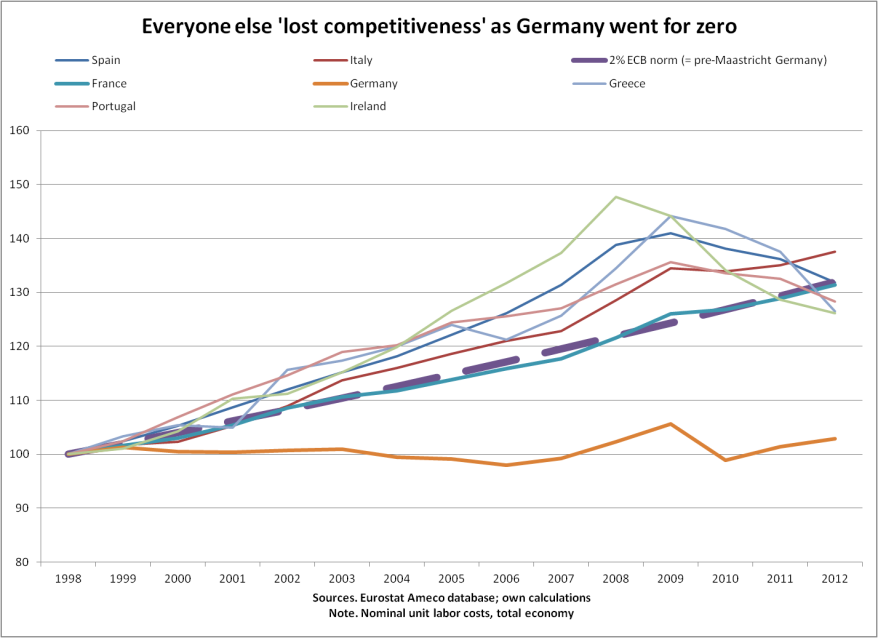

Unfortunately, euro weakness as the supposed solution to the euro crisis is a thoroughly misguided piece of advice. The idea about the euro being expensive for some but cheap for others at its current level is nothing else but the external mirror image to the fact that competitiveness positions inside Europe’s currency union are utterly unbalanced – which led to corresponding intra-area current account imbalances and debt overhangs. While this is a correct diagnosis of intra-euro imbalances, implying a need for rebalancing, it must be stressed that there was absolutely nothing inevitable about this outcome. It was just that, contrary to the requirements of a currency union, Euroland simply failed to keep unit-labor cost trends within the union aligned with the commonly agreed two-percent inflation norm. In particular, as Germany stabilized its nominal unit labor cost trend at zero under the euro, the country turned űber-competitive in due course as a result. This resulted in the buildup of excessive current account surpluses – with corresponding German exposure to debts issued by its euro partner countries and exuberantly gobbled up by German banks and investors.

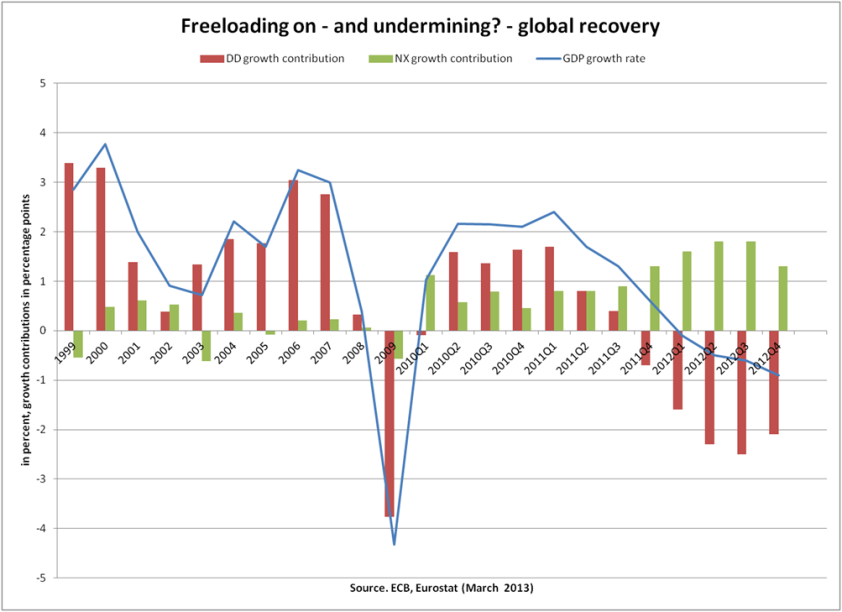

Perversely rewarded by the markets, Germany is imposing competitive austerity on its uncompetitive partners as the cure-all that is supposed to restore stability as well as growth. Quite predictably, the result of allegedly “growth-friendly” continent-wide austerity is catastrophic. Domestic demand in the eurozone has been shrinking for over a year now, at an annual rate of around 2 percent. The decline in GDP has been contained to less than one percent only due to a very sizable positive growth contribution from net exports.

How much more stimulus from abroad does Euroland deserve for its rescue, one may then ask? Do Messrs Feldstein, Darvas, and Keohane suggest that Euroland has some natural right to enjoy an export-led recovery? The German authorities may well think so. And if the euro were to weaken and hence propel Germany’s exorbitant external imbalance of currently around 7 percent of GDP toward and beyond 10 percent, they might sing Germany’s competitiveness anthem (“envy of the world”) even prouder.

Beware handing out open invitations for pursuing beggar-thy-neighbor policies, policies that risk triggering currency wars, trade wars, and more. Euroland is already sucking the air out of the global recovery in a big way. Both the U.S. and China, the two key engines that have done most of the heavy-lifting since 2009, seem to be losing steam by the day. It is highly doubtful that the global economy can withstand even more collateral damages resulting from Europe’s ongoing economic suicide. Arguably, the euro should rise sufficiently so as to concentrate the damages locally where they are inflicted, instead of burdening the world community with the consequences of – never-ending? – euro folly. This is not a matter of reasonable international burden-sharing but a matter of enticing the euro authorities to “get their own house in order.”

ShareThis

ShareThis