On Sectoral Balances, Power Imbalances, and More

[The following is the text of Senior Scholar Randall Wray’s presentation, delivered October 28, 2011, at the annual conference of the Research Network Macroeconomics and Macroeconomic Policies (IMK) in Berlin. This year’s conference was titled “From crisis to growth? The challenge of imbalances, debt, and limited resources.”]

It is commonplace to link Neoclassical economics to 18th or 19th century physics with its notion of equilibrium, of a pendulum once disturbed eventually coming to rest. Likewise, an economy subjected to an exogenous shock seeks equilibrium through the stabilizing market forces unleashed by the invisible hand. The metaphor can be applied to virtually every sphere of economics: from micro markets for fish that are traded spot, to macro markets for something called labor, and on to complex financial markets in synthetic CDOs. Guided by invisible hands, supplies balance demands and all markets clear.

Armed with metaphors from physics, the economist has no problem at all extending the analysis across international borders to traded commodities, to what are euphemistically called capital flows, and on to currencies, themselves. Certainly there is a price, somewhere, someplace, somehow, that will balance supply and demand—for the stuff we can drop on our feet to break a toe, and on to the mental and physical efforts of our brethren, and finally to notional derivatives that occupy neither time nor space. It all must balance, and if it does not, invisible but powerful forces will accomplish the inevitable.

The orthodox economist is sure that if we just get the government out of the way, the market will do the dirty work. Balance. The market will restore it and all will be right with the world. The heterodox economist? Well, she is less sure. The market might not work. It needs a bit of coaxing. Imbalances can persist. Market forces can be rather impotent. The visible hand of government can hasten the move to balance.

Balance is nice; it’s intuitively appealing. In truth, it was not invented by physics. All cultures view it as natural. It is the universal condition—both in nature and in human society. It reflects an inner yearning for fairness. As Margret Atwood explains, all human and ape societies have recognized the law of reciprocity—you will pay back in this life or the next. There is an innate notion of equivalent values, and therefore of balances. Animals can tell “bigger than” and they revolt when they are shorted. Even the rat knows it’s not fair. She goes on strike if you try to reduce the reward for running a maze. That violates the rat notion of balance.

There is a right way to do things. Failure to follow tradition upsets the balance. Who knows what wrath imbalance might invoke among the gods. Gabriel, the Angel of records, keeps God’s ledger book—to be produced in the Last Judgment. Too much imbalance in your life and you go to hell. And, as we know, Lucifer records the debts—of the souls he will collect. He’ll sell you a good time now, but your soul lies in the balance. You buy now, you pay forever. Sort of like Student Loans in America. The only things in life you cannot escape are death and taxes. The Devil has a lock on both of those. He’s the tax collector who calls at death. Once your soul is sold, there is no balance. It’s the roach motel—you’ve checked in and you will never get out.

But Christ is the redeemer—he’s a sin eater, repaying your debts to restore balance, to let you sinners get to heaven. Muslims refer to the scales of justice—your good deeds are weighed against the bad ones. There is a balancing out—you might just tip the scales. Much earlier, the God of Time was a Scribe as well as the God of Measurement and Engineering—how would you like that job description? He kept the records, measured worth, and built the scales. At death, he weighed your heart to assess your value.

I suppose you all know that the Pope or Pontiff came out of the engineering gens of one of the Tribes of Rome—that built all the bridges, or ponte, over the Tiber river and followed the example set by the engineers of the Nile by becoming the priestly upper class.

Time, Measurement. Balance. Everything you need for money and accounting. And of course none of you is debt-free—original sin ensures that from birth. Can you redeem yourself? Not likely. You need help.

So from time immemorial debts would be periodically canceled—the Year of Jubilee. With every change of ruler (who of course, was an earthly God of Measurement) or every 7 years or 30 years depending on sinfulness, all debts were canceled. Babylonia chose 30 as the likely reign of a ruler; the Bible chose 7—the lucky number, a 7 year ever-normal granary would get you through a drought. Debt cancellation.

Why? These were no bleeding heart liberals. No, debt cancellation was to restore balance. If all your subjects are in hock to creditors, you cannot rule them. So you eat their sins, redeem their debts, free them and their wives and kids from debt bondage. Hallelujah!

Now why do we need periodic debt cancellation? The Sotty principle. Compound interest trumps compound growth. As Michael Hudson says, humans recognized this even before they invented writing. The earliest textbooks showed how to calculate compound interest.

It was our first imbalance—our first violation of natural law. It would inevitably lead to concentration of wealth—like the game of Monopoly, the last player standing would take all. So from Babylonia to Rome, balance was restored by canceling debts.

Time was circular: time and accounts would reset at zero when the slate was wiped clean. Time and debt are inherently related. Time compounds the debts at the rate of interest. In Heaven there are no debts and no time; in Hell all debts are compounded forever. Redemption allows time and debt to start over from balance.

But with Roman Law we abolished circular time. Henceforth it moved in one direction only—from a largely known past to what Paul Davidson would call a fundamentally uncertain future. No more debt cancellations. Just debtor’s prisons—where the debtor would be held until family could redeem him. Later we used prisons and execution simply for retribution—an eye for an eye, a life for a life, so that the scales would balance.

But debtor’s prisons destroyed the balance between creditors and sovereign—just as debt bondage had several thousand years earlier. With the family head in prison, it was impossible to repay. Again, bankruptcy was invented not out of compassion but to restore the balance between the rights of rulers and of creditors.

Yet bankruptcy only allowed a partial reset. It was a poor substitute for Jubilee and Hallelujah. And the Creditors ran the show. They liked inequality; they liked imbalance. As Kenneth Boulding used to say, surveys of the rich consistently show that you cannot imagine how incredibly greedy they are, and how monumentally stupid they are, too. They will gleefully roast the goose that lays the golden egg. If you do not believe that, you have not been watching Wall Street over the past decade. Or what Germany is doing to Greece and Ireland. When creditors have too much power, they destroy the balance.

So let’s bring this to the present. Credit and debt are two sides of the same coin. Both creditor and debtor are sinful. They balance. Exactly. The balance is ensured by double-entry book-keeping. Redemption frees both creditor and debtor. It results in a different balance—one without sin. Bankruptcy also results in balance, but one that maintains the power of creditor over debtor—at least within the limits of law.

But the point is, debts and credits are always in balance. In the private sector, as we always say, inside debts net to zero. Balance. When we include a government, its IOUs are balanced by credits held by the nongovernment sector. The nongovernment sector’s net credits are claims on government. The government’s deficit means a nongovernment surplus. It balances. And when we include an external sector, a domestic deficit must be balanced by a foreign surplus. It, too balances.

There is always financial balance. Imbalance can arise only due to arithmetic errors. Looking at our global mess as a financial imbalance—as almost everyone does—is a mistake. Our mess is not due to excess liquidity sloshing around the world in the mid 2000s. It is not due to excessive borrowing by America from the Chinese. And it is not due to profligate spending by Mediterraneans with too little self-control.

We need to look at this the way Babylonia’s rulers saw it. The problem is a balance of power, not an imbalance of finance. And to understand this, we’ve got to understand what money is. We need to return to Keynes’s Treatise on Money.

I know I’ve used up half my time with this introduction. But that is OK because many of you have heard me talking about Keynes’s State Theory of Money for the past 20 years. I’ve got nothing new to say about it. What we now call Modern Money Theory is out there—in academic publications, in policy notes, and all over the blogosphere. It combines the insights of Knapp, Keynes, Innes, Lerner, Minsky, Godley, and Goodhart.

To greatly simplify, money is a measuring unit, originally created by rulers to value the fees, fines, and taxes owed. By putting the subjects or citizens into debt—original sin—real resources could be moved to serve the public purpose. Taxes drive money. This is why money is always linked to sovereign power—the power to command resources. That power is rarely absolute. It is contested, with other sovereigns but often more important is the contest with domestic creditors. Too much debt to private creditors reduces sovereign power—it destroys the balance of power needed to govern. So money was created to give government command over socially created resources.

We can think of money as the currency of taxation, with the money of account denominating one’s social liability. I have to deliver a dollar’s worth of commodities—including labor power–to satisfy the public interest. Often, it is the tax that monetizes an activity—that puts a money value on it for the purpose of determining the share to render unto Caesar. The sovereign government names what money-denominated thing can be delivered in redemption against one’s social obligation or duty to pay taxes. It can then issue the money thing in its own payments.

That government money thing is, like all money things, a liability denominated in the state’s money of account. And like all money things, it must be redeemed, that is, accepted by its issuer. It’s not money that the sovereign wants—she wants real resources. Money receipts is the tool, not the goal. If private creditors run the economy there just isn’t enough power to produce left for the sovereign—for the public purpose. Government has an unlimited supply of its own money—but there have to be available productive resources.

In modern economies that is not the usual constraint, however. Government’s sovereign power is constrained in two main ways: arbitrary self-imposed budgetary constraints, and exchange rate constraints. Many countries happily impose both types—including Euroland. The handcuffs of budget limits were not enough—so they imposed the ball and chain of the Euro. We can observe the fall-out right now.

A sovereign government that issues its own currency faces no financial constraints. It cannot produce a financial imbalance. It can buy any resources that are for sale in terms of its own currency by using keystrokes. That does not mean it should try to buy all the resources—it can certainly produce inflation and it can leave too little resources to fulfill the private purpose. Government needs to use its sovereign power to move just the right amount of resources to serve the public purpose while leaving enough for the private purpose. That balance is mostly political. It is hard to find. I admit all that.

But trying to use an arbitrary budget limit or supposed “balance” between tax receipts and monetary spending is the worst possible way I can conceive of trying to find the right balance between the public and private purposes. What it usually does in reality is to leave the resources unused—wasted—rather than to leave them for the private purpose. Much better is to explicitly decide: what do we want government to do? What do we want our private sector to do? Do we have a sufficient supply of resources domestically plus what we can obtain externally to achieve both? If we don’t how can we expand capacity as needed?

I’m not necessarily arguing for a planned economy as usually defined. But of course, all economies are planned, of necessity. The question is by whom and for whom.

These are the real issues, they are difficult, they are contentious. But they have almost nothing to do with the size of a budget deficit. It is worse than pointless to set a deficit ratio goal of 3% or 6%, and a debt ratio goal of 60%. It is counterproductive.

Let me turn to the other self-imposed constraint: pegged exchange rates. Adopting a gold standard, or a foreign currency standard (“dollarization” or “euroization”), or for that matter a Friedmanian money growth rule, or an inflation target is a political act that serves the interests of some privileged group. There is no “natural” separation of a government from its money. The gold standard was legislated, just as the Federal Reserve Act of 1913 legislated the separation of Treasury and Central Bank functions, and the Balanced Budget Act of 1987 legislated the ex ante matching of federal government spending and revenue over a period determined by the heavenly movement of a celestial object. And of course all the Euro arrangements that have led to the current crisis are legislated—not natural. Ditto the myth of the supposed independence of the modern central bank—this is but a smokescreen to hide the fact that monetary policy is run for the benefit of Wall Street and London and Frankfurt and Paris.

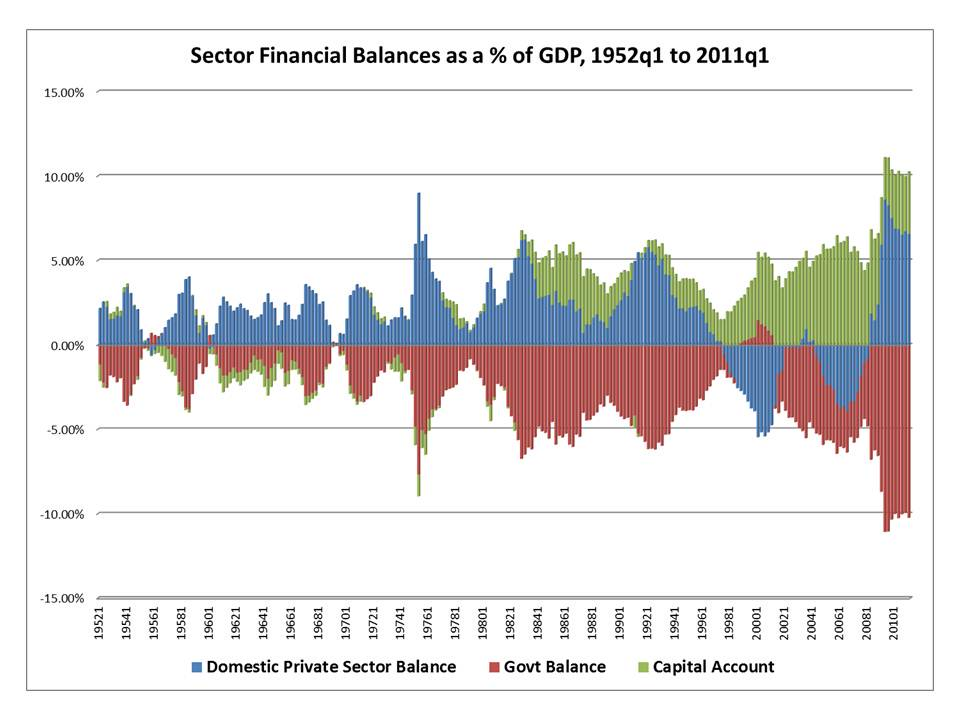

Wynne Godley taught us about balances—the sectoral balances. Take a look at the US case.

US Sectoral Balances

What do you see? Balance. A mirror image. In normal times, the private sector surplus plus the current account deficit equals the budget deficit. In the abnormal times of private sector deficits, we still saw balance—the government even ran budget surpluses for a few years to maintain the balance.

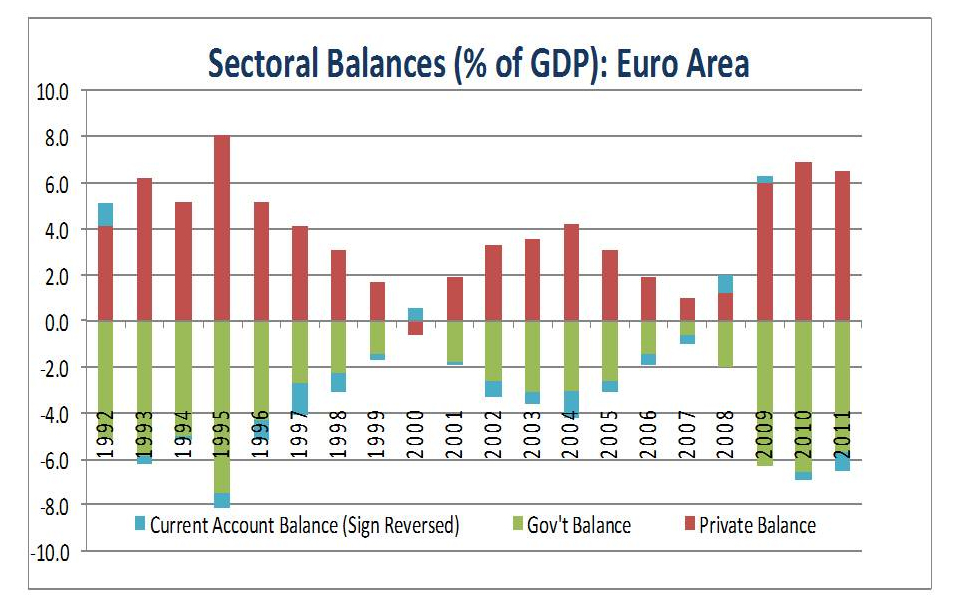

Take a look at Euroland; what do you see?

Euroland Sectoral Balances

Balance. Isn’t it amazing. Whenever the private sector surplus rises, the budget deficit rises; the correlation is near 100%, with the current account acting as the balancing item.

Financial balances balance.

If you take the world as a whole, there is no external sector since we don’t trade with Martians. And so the sum of the global government deficits equals the sum of the private sector surpluses. It balances.

What’s the problem in Euroland? Power. Private creditors in central Europe have too much of it; Sovereigns on the periphery have too little. The creditors are starving the member states, aided and abetted by the Euro, which usurped sovereign power and handed it over the banking elite.

But even still, the balances balance. You can curse the moon for its travels but it still is going to circumnavigate the globe. Admonish the Mediterraneans all you like for their budget deficits, but they still will have them compounded by the German export surpluses. The real imbalance is power.

And this isn’t just a European disease. There is a generalized perception of a world out of balance. We’ve got Arab springs, Occupy Wall Street movements, and protests all over Europe. Why? Imbalances: everywhere I look in the Western world, the public sector is too small; we’ve privatized too many essential public sector functions—our arts, culture, prisons and punishment, military in Iraq, increasingly our education, our motor vehicle departments. All privatized. Even responsibility for full employment, and supervision of our banks. We let them self- regulate, and even self-prosecute, self-punish, self-flagellate. What happens? Fraud, unemployment, inequality, poverty, and inadequate healthcare, retirement, and welfare.

If you think about it we chose the worst of all possible times to embark on the great Neoliberal experiment—downsizing government, privatizing many of its functions, slashing the safety net. In the West we are aging—which creates the twin problems of the need to devote more resources to aged care and at the same time a private desire to accumulate financial resources for individual retirements. And that in turn led to the accumulation of unprecedented financial wealth under management by professionals.

Current and future retirees demand higher returns to increase their security and what Minsky called Money Manager Capitalism responded by pouring more resources into the financial sector, doubling its share of value added and capturing 40% of all corporate profits. It’s too much. Finance is at best an intermediate good that might in the best of circumstances contribute to production. At the same time, financial wealth represents a potential claim on output but does not guarantee output will be available as needed. We need old folks homes but finance is more interested in gambling on CDOs squared and cubed.

But it is worse than that. Modern finance, at least what is practiced at the biggest banks, is about fraud.

So finance is not even a zero sum game—it largely makes a negative economic contribution.

So the imbalance is one of power. The disease is Money Manager Capitalism. The symptom is the subprime frauds in the US, the austerity imposed on Greece and Ireland, the stagnation of incomes in most developed nations, the rising inequality and poverty in the midst of plenty, the growing despair and feelings of hopelessness.

There are no quick fixes, no magic bullets. The solution is not to slash government spending in Greece. Even reform of Maastricht rules plus bigger bailouts is not a solution. Nor can it be found in some new international monetary system based on a bancor and run by the Money Manager Neoliberals.

No, the reforms must be fundamental.

ShareThis

ShareThis

Great article, thanks for posting.

I especially like the graphs of the sectoral balances. Would you be willing to share the underlying data used to produce them or the exact data sources (if available online)?

Thanks and keep up the great work!